Alternative Credit Scoring Insights

by Riaz Jassat, Chief Commercial Officer, Qarar

In this article, Riaz Jassat gives an overview of the possibilities for the alternative credit scoring arena in the Middle East.

To set the scene, Qarar enhances lending decisions through data science, advisory and automation software. We have a strong pedigree of data scientists working closely with our advisors to harness the power of predictive analytics. This allows us to guide our clients in terms of working with data, identifying insights, and turning those insights into more profitable decisions for growth. When it comes to digital lending, we have leveraged the predictive power of alternate data through the development of algorithms for turning this alternate data into actionable insights for credit decisioning.

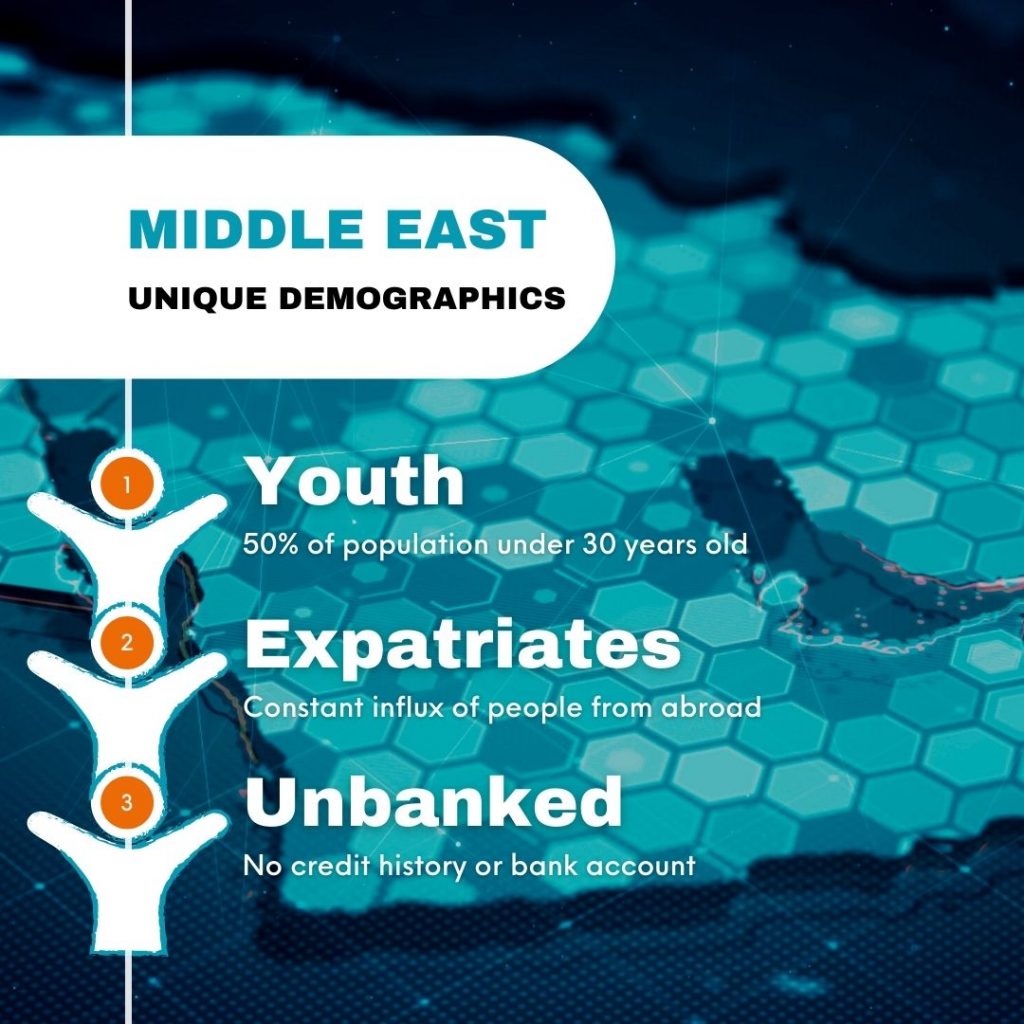

UNIQUE REGIONAL DEMOGRAPHICS

Where it gets exciting is the huge potential of alternative data in the Middle East, specifically on the credit-invisible population. Some illustrations of the credit-invisible population are:

YOUTH. There’s such a massive youth population in the region — more than 50% of the population are young people under the age of 25. In fact, current statistics show that almost 70% of the population in Saudi Arabia is under 30 years old. This significant youth market will fuel a lot of growth in the next 5 to 10 years. We know, currently, it might not seem that attractive to a lot of lenders. However, it is a segment that cannot be ignored and requires focus.

EXPATRIATES. A different segment which can be considered credit-invisible is the expatriate segment. Somewhat unique to the Middle East — for example, Dubai and the UAE — almost 90 percent of the population are foreigners, and this population is moving in and out, in and out. Any new entrant that comes into the country is essentially credit-invisible to any of the lenders based in these regions. For lenders to be able to grant credit, the risk factor is significant as these is very little data — and specifically traditional data — used in risk assessment to work from. So, for this segment we can see how alternative data would assist both lenders and expatriates in granting/accessing credit.

UNBANKED. A third segment which spreads wider than just the Middle East is the previously unbanked, or unbanked, population. There is significant drive from governments for credit inclusion initiatives. Due to the credit invisibility of this segment alternative data — once again —proves its might in assisting both lenders and the unbanked segment in granting/accessing credit.

INTRODUCING ALTERNATIVE DATA FOR CREDIT SCORING

For the majority of these credit-invisible populations/segments, a common factor is high mobile penetration/usage, and presents a valuable opportunity for alternative data inclusion in credit scoring. As these credit invisible segments have little traditional data for traditional credit scoring, their significant demographic creates a huge market opportunity for specific lending products and services — and the region is wide open to understanding, adopting, and using these new technologies. Much of this drive is coming through mobile. That’s where alternate data is going to provide a significant uplift to any lender that wants to start lending services to the previously unbanked population. Central banks are aggressively pushing this and there’s a lot of effort being put into getting these people banked, getting them onto electronic payments, transitioning away from cash and embracing this new era of digital lending.

A SNAPSHOT OF THE NEW CUSTOMER JOURNEY

To put it bluntly, everything is going digital, and payments are going mobile. If you look at some countries, mobile payments have seen astronomical growth over the last decade. Across all these unique regional segments the common factor is they are all mobile savvy. That means all this mobile data can be capitalised on and classified as an alternate source of data to help make better decisions, and to start including them into the banking sector.

Along with the growing digital lending trend, what customers are looking for, these days, is simplicity and transparency. Youth, for example, have no reservations in sharing their data — provided they know how, when, where and why their data is used. They are not looking for fine print, but rather something that is digital, transparent, and something that they can trust — no hidden clauses! To be able to have that seamless journey we need all our APIs, systems, and integrations in place, and we must have data and analytics. Therefore, it is imperative that all the different sources of data that we can get our hands on are explored. Then, how can we use this data and turn that data into insights? We also need to have a set of policies and procedures that will govern our lending program.

These are the foundational pillars, and once they are in place, together with the trust, transparency, and simplicity, it turns into a successful USP or a product for the end consumer.

CONTINUE TO PART 2 The Immense Potential of Alternative Credit Scoring in the Middle East – Part 2 – Qarar