Alternative Credit Scoring Insights

by Riaz Jassat, Chief Commercial Officer, Qarar

In this article, Riaz shares guidance to lenders on leveraging alternative data to develop new products and services for previously untapped market segments in the Middle East.

EXPLORING THE NEW CUSTOMER JOURNEY

Let’s take a look at the new customer journey from the lender’s perspective. What steps need to be taken to create a new product or services such as a lending product for the youth population that are currently credit invisibles? And how would they go about it?

Legacy banks have not been easily geared toward this type of lending — usually it required physically going to a branch and having to bring multiple documents for verification, and so on. Now, many of them are making significant effort in rewriting the new customer journey. Essentially, it needs to be a no-fuss approach to banking and to understand the journey from the customers’ perspective. What customers want is to go through the entire journey from their mobile device at any time, 24/7. They want to be able to go through the whole process from the very first interaction on the App — getting themselves verified, getting their account opened, and getting a virtual credit card or loan issued to them in just 6 or 7 clicks. This is where alternative data comes to the fore.

However, it is important to understand there is no one size fits all in this customer journey. In the unbanked or deprived population, they would accept a journey of 10 – 12 clicks and a little more information and verification would be required. So, there’s no one size fits all – we need to understand each customer segment, who we are lending to and what the expectations are — and that will mean some variations across the customer journey.

SETTING IT UP

Once the customer segments and variations across the journeys have been established, it is a relatively straightforward process from a system perspective, and then start executing the APIs or payment wallets.

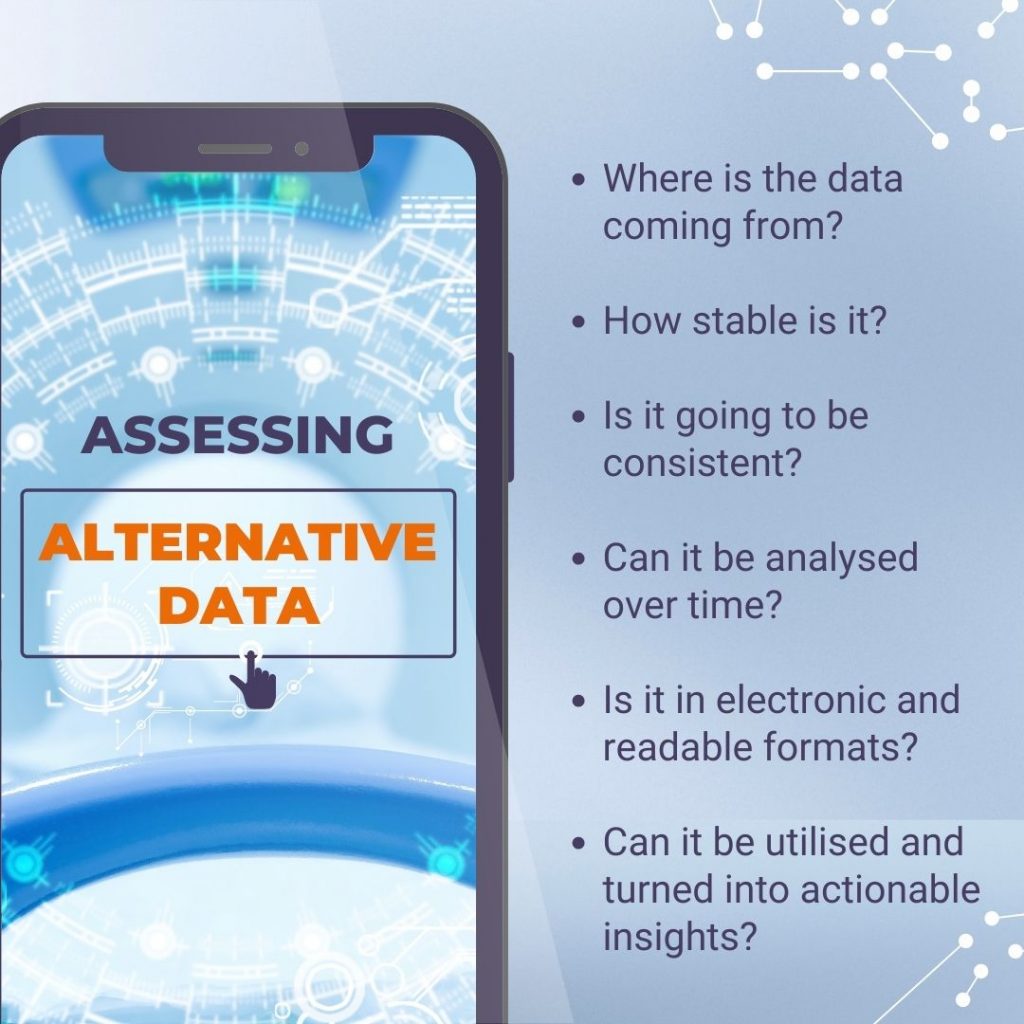

The secret to successfully rolling out lending products to new customer segments lies in a robust credit decisioning process and the integrity of the alternative credit scoring data coming in.

It is all about taking the data, learning from it, and going through this champion challenger process every year — constantly challenging, enhancing and looking at new data sources to be able to automate this lending decision so that we can have fast banking in a matter of seconds.

PLATFORMS

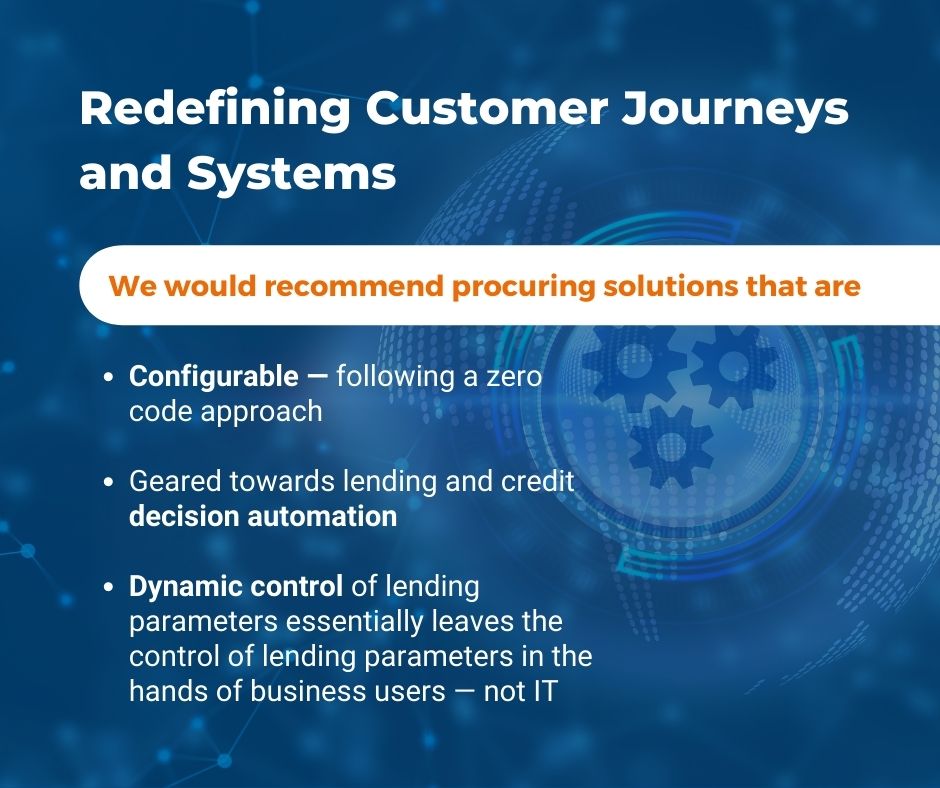

Having the right platforms in place at the very beginning is paramount to having a dynamic customer journey that can be adjusted as per individual customer needs going forward. We have so much more data available today that can be leveraged for making sound lending decisions. It is already there, waiting to be processed and utilized through a decisioning engine.

It also allows for dynamic control of lending parameters and essentially leaves the control in the hands of business users. Removing the reliance from IT and putting the reliance into the business users is the new model. There are already systems available that will allow lenders to do this — in fact that’s where Qarar can step in — and that’s exactly what we help our clients with.

Our message to lenders is clear: when it comes to the systems, you need a good rules and decision engine that, as a lender, allows you to bring in new data sources, that allows you, as a business user, to be in control of your parameters, to be in control of your credit decisioning, your scoring, your risk assessment, your risk-based pricing, your affordability, your limit calculations, etc.

SMART SEGMENTATION IS NON-NEGOTIABLE

The systems, tools and data sources are already there, but lenders need to have realistic and appropriate customer segmentation already established. For example, lenders are not going to utilise this type of alternative data for mortgage applications because customers are not going to be applying for a mortgage if they are credit invisible. They would need to take the first couple of steps before they reach that rung of the ladder. So, the first rule is to find the right suitable population, and then redefine some of the product offerings. This might be a really small credit offer — and then let that person keep repaying and moving them up the value chain very quickly and dynamically. Setting up rule-based decision engines ensure customers can be moved up the value chain with ease and speed, and this is when more flexibility and different products or services can be offered.

“Small first steps, and continuous re-evaluation”

It is all about understanding where the customer is in their life stage, and personal life journey. As long as the product offering is matching — or exceeding —where they are in their life stage, it will always be attractive to them.

TAKING THE NEXT STEPS

We are working with an ever-changing, ever-demanding customer base these days — and that is not going to change. For lenders it is not so much about survival of the fittest, but survival of the most adaptable and flexible. Also, choosing the right partners to help build decisioning systems that can process the growing universe of alternative data for optimum lending decisions.

The next steps forward to reaching new and untapped populations are entirely in the lenders’ hands, and it all comes down rethinking the product structure from the point of the view of the customer.

“Simple, yet powerful”