Affordability — Why do we need to verify lifestyle expenditures?

Creditworthiness comprises of both credit risk for the lender and affordability for the borrower. While most lenders have a strong commercial incentive to evaluate credit risk, including the likelihood of non-payment, there may be a lesser incentive to assess the potential impact of the credit on the consumer’s broader financial situation, especially when these consumers remain profitable for the institution.

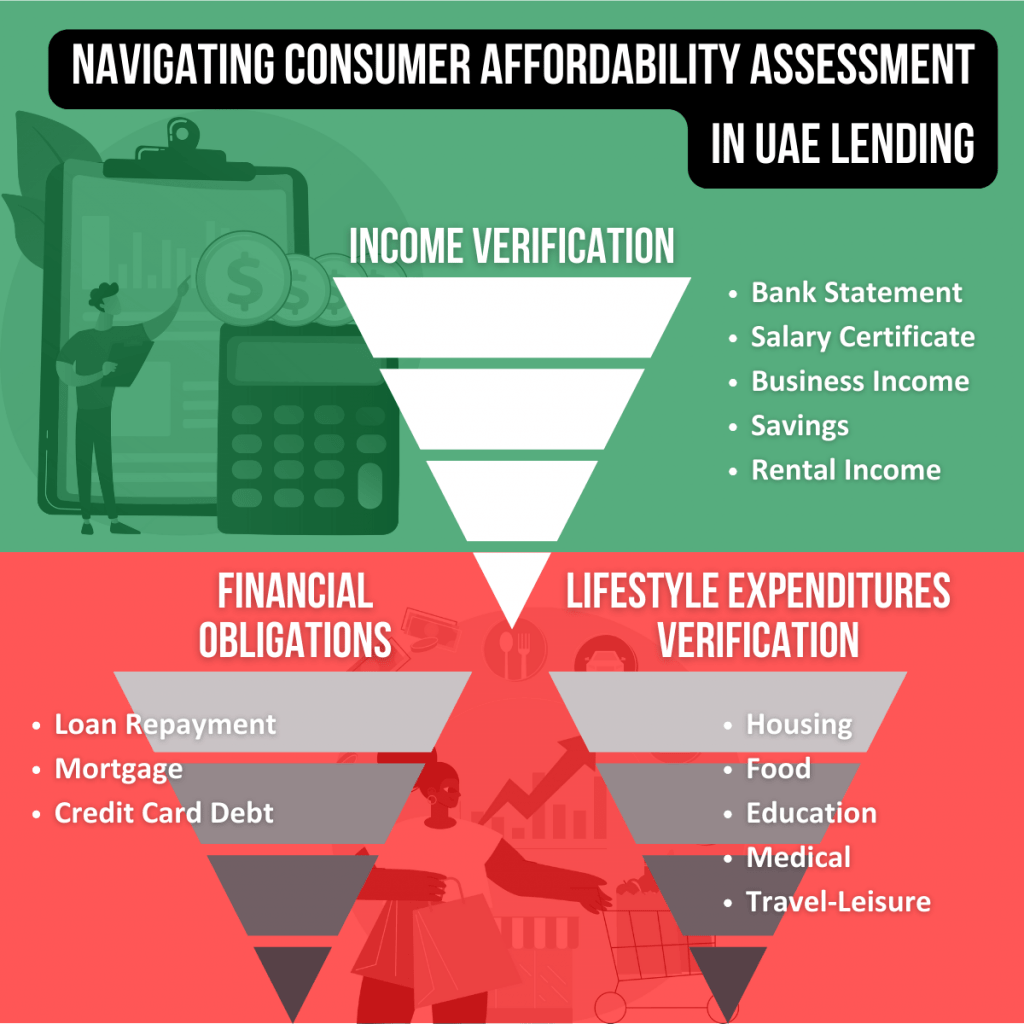

To ensure institutions operate responsibly, consumer lending in the UAE operates within a framework that mandates responsible lending practices. Central to this approach is the consumer assessment of affordability, a crucial step that ensures borrowers can manage their financial obligations. In this blog post, we’ll explore the key aspects of affordability assessment, regulatory context, and how financial institutions can navigate this landscape.

Regulatory Landscape

In the UAE, responsible lending is mandated and enforced by the Central Bank of UAE (CBUAE) through Article 7 of the Consumer Protection Standards. Article 7.1.4 of the standard defines the requirements on consumer assessment of affordability, taking into consideration borrower income, existing financial obligations, and personal lifestyle expenditures. Whilst Article 7.1.4 follows a principle-based approach to regulation, the CBUAE released “Guidance on lifestyle expenditure and income” that is prescriptive in the approaches that may be adopted and information that can be obtained in the assessment of expenditure and income.

Components of Affordability Assessment

Income: Lenders assess the borrower’s income to determine their financial capacity. This involves verification of pay slips, bank statements, or similar documents. Non-salary sources may be considered for income assessment, where appropriate, and can include savings, business income and rental income. Importantly, allowances such as free tuition, free accommodation etc. should not be considered as an income source.

Financial Obligations: Lenders assess outstanding debt obligations, such as loan repayments, mortgages, and credit card debts, to determine borrower’s overall indebtedness. Typically, this information is verified through the Credit Bureau (AECB) and is used to calculate the Debt-to-Burden (DBR) ratio.

Lifestyle Expenditures: Lenders assess the borrower’s monthly basic personal and lifestyle expenditures, including housing, food and education. Lenders, at minimum, must provide consumers with a detailed questionnaire to self-declare their lifestyle expenditure; however, self-declared expenditure cannot be relied on solely and contractual and non-discretionary expenses must be verified. Furthermore, the DBR should be suitably adjusted to reflect the lifestyle expenditure.

Challenge of Verification of Lifestyle Expenditures

The CBUAE provides a list of documents to be considered as part of the verification, including bank statements, rental agreements and utility bills. Undertaking verification of lifestyle expenditure can be costly and cause friction in the lending process. However, verification should be both proportionate and reasonable given the borrower’s circumstances.

To support verification and ensure institutions apply a proportionate approach, lifestyle expenditure models can be incorporated into their affordability assessment. These models provide both credible intervals and expected estimates of lifestyle expenditures, which can be used as a first step verification of self-declared expenditure. Where self-declared expenditure deviates from the model credible intervals, lenders can employ further manual verification checks as circumstances require. This has the benefit of reducing the cost of undertaking manual verification, whilst also ensuring a proportionate approach is applied to assessment.

Qarar has developed and successfully deployed affordability models in the KSA and UAE. Please contact us to discuss how Qarar’s Affordability Solutions can help your financial institution’s Credit Risk Management.