Managing the upsurge of forbearance requests

By Charl Lategan, Head of Advisory Service Middle East

The COVID-19 impact on the world has been devastating. As the world is trying to process this pandemic, they are also trying to find cures, enhance treatment and develop a vaccine, all whilst the bills, unfortunately, still need to be paid. Governments and central banks, as well as some of the wealthy, have provided stimulus and sponsorship but mostly to keep corporates and small business afloat. There is little being allocated to the retail consumer financial shortcomings. As a result, this leaves a sizeable debt repayment gap, especially in the case of heavily overextended country populations.

Many financial institutions have responded to this shortage by publishing aid in the form of “payment flexibility”. This article further investigates the potential solutions by looking at how these institutions can and are approaching this problem.

Who should be the target customer group?

Proactive Identification: The first important analytical question banks should be asking themselves is who should they be targeting proactively to offer these flexible payment options? Whether this segmentation can be done by the internal analytical team or outsourced, it is key to identify this population quickly and accurately. The target group should typically be on the edge of the less durable affordability scale and within mid/high risk range on a behaviour risk scoring classification. These are typically the customers that would fall out of credit risk appetite policy in a stressed scenario and might even have shown their faces in collections before.

Re-active Identification: This entails institutions offering a slick, easy-to-use get-in-touch method. It could be facilitated through text messaging, inbound IVR, email and online servicing. It is important to offer these services in a private manner as customers might be ashamed to ask for this type of assistance. Once the customer gets in touch, the flexible payment options should be positioned in a clear and concise manner. Only the options that the customer qualifies for should be offered.

Both Proactive and Reactive Identification involve analytics, operational systems, and heavy staff training.

Types of payment plans

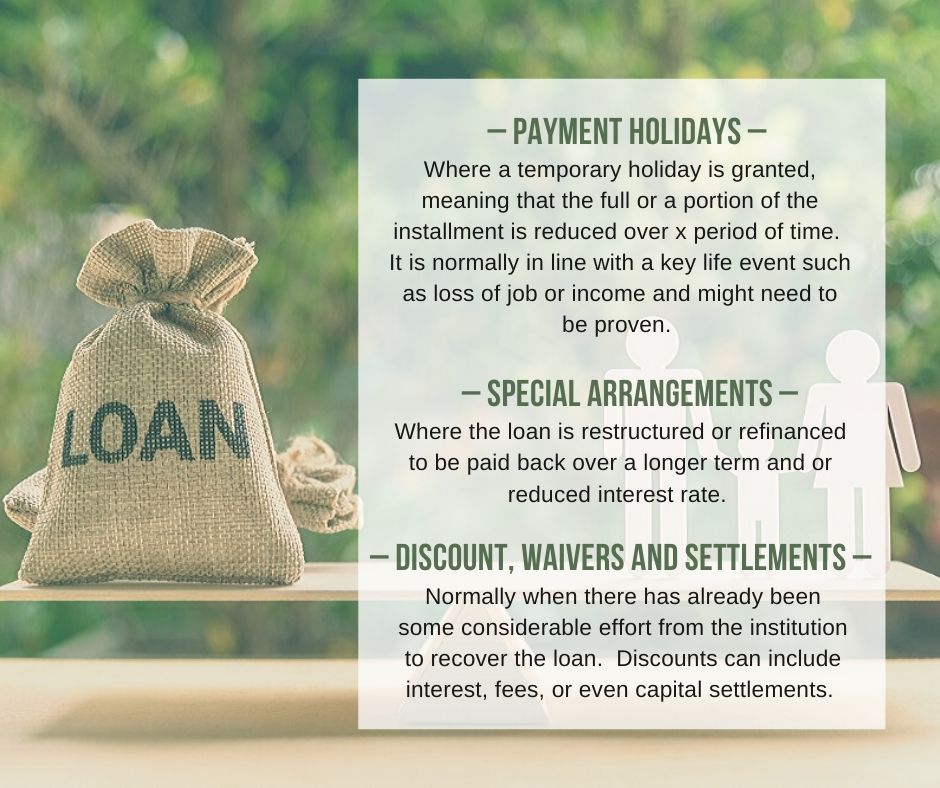

Flexible payment plans are not a new phenomenon and have been used by lenders over the years to accommodate temporary financial difficulty, with the emphasis on temporary broadly defined as 3 – 12 months. These plans have taken on many names and forms across the world with the generic forms including:

Other important considerations

In all the above mentioned plans the enrolled customers should be ringfenced from an accounting, systematic and contractual obligation point of view. It should also be noted that any future collection treatments should be escalated much faster compared to normal portfolio collection activity. In the case of secured lending, acknowledgement should also be taken for the current true market value of the asset and subsequent predicted depreciation before concessionary action. Lastly, it is critical to monitor and treat these customers differently as it can quickly erode portfolio profits, BUT it should lead to customer longevity.

How can Qarar assist you?

Qarar is specialised in creating these types of solutions for lenders through our analytics, advisory and software arm. To ensure your institution is ready for offering flexible payment plans we can assist you with the following in this regard: