The Situation, The Impact and The Mitigation

by Amit Kumar, Senior Consultant

Without a doubt the number one thing on everyone’s mind these days is the disease caused by COVID-19, a variation of the Corona virus. Dominating the world media around the clock this global pandemic is now totally controlling people’s lives and jeopardising the economy, businesses and turning our livelihoods upside down. Social-distancing and self-isolation, previously rarely used phrases, are now the new norm and are a drastic response to what is the most serious threat to humanity in centuries. Right now, virtually the whole world is on total lockdown to combat the spread of the virus.

The disease has been declared as pandemic by the World Health Organization (WHO) and has already affected hundreds of thousands of people across the globe with thousands of deaths reported from virtually all countries; China, Italy, Spain, Iran to name a few. While Government organisations and medical professionals across the globe are busy finding ways to stop spread of the virus and finding a cure – including complete lock-down in most countries – it has been widely accepted that this situation is going to impact the global economy adversely.

According to the World Trade Organisation (WTO) global trade is expected to witness a sharp fall due to the COVID-19 crisis and global solutions will be required to deal with the pandemic. WTO is of the opinion that cross-border trade and investment flows have a role to play in efforts to combat the pandemic and will be vital for fostering a stronger recovery once the medical emergency subsides.

The Situation

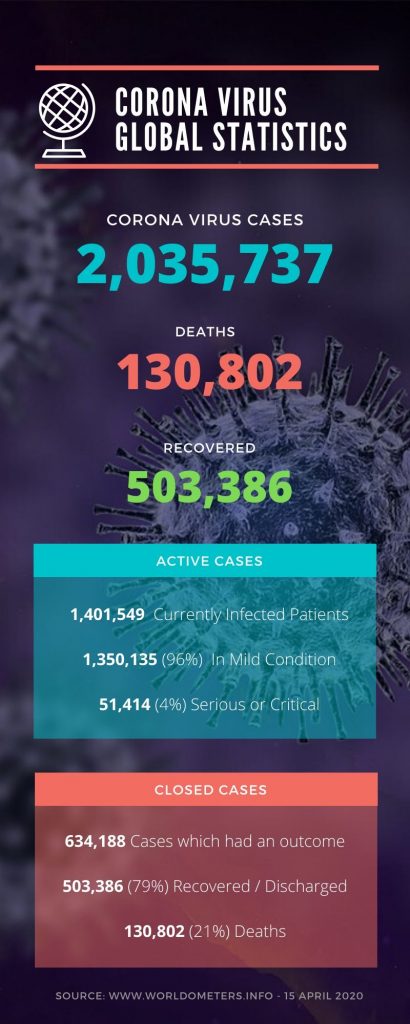

The global statistics are still rising. As a basic indication, Figure 1 presents the statistics of the impact of the virus on lives of people. As per this figure, 2,035,737 people have been reported to be infected by the corona virus globally as of 15 Apr 2020, and of the confirmed infected cases, 503,386 have recovered so far.

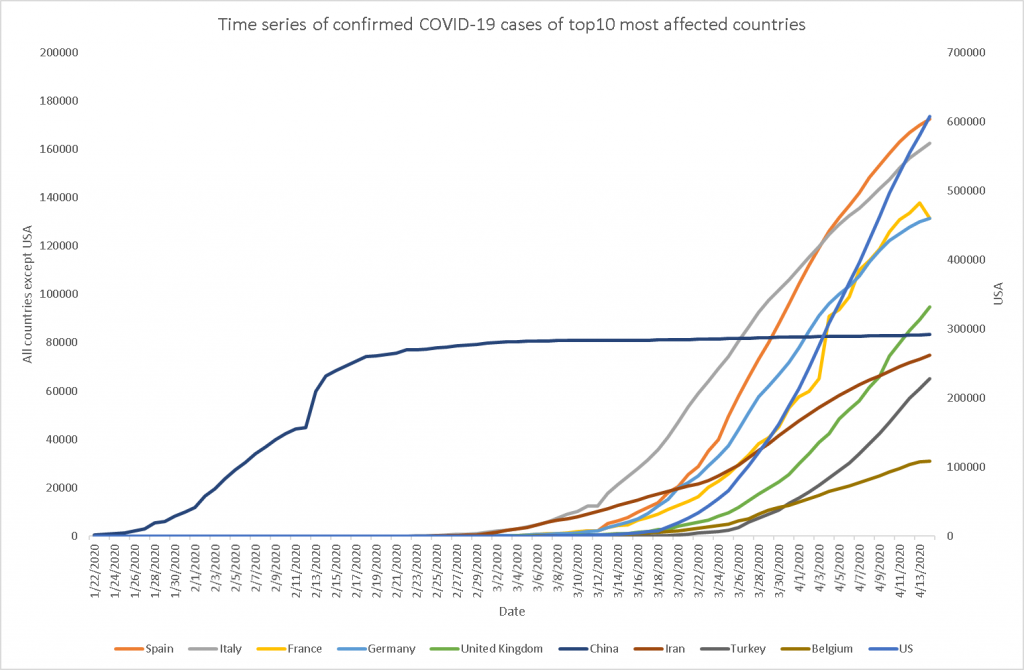

While the recovery rate from the total reported cases is around 24.7%, the mortality rate is around 6.4%. These are serious numbers which have impacted lives of people around the word. Figure 2 presents the timeseries of cumulative growth of confirmed cases of top 10 most affected countries by number of cumulative cases reported as of 14 April 2020. It is important to note that while Italy, US, Spain and Germany observed confirmed cases later than China, the rate of growth of confirmed cases for these countries as indicated by the chart shown in figure 2 is higher than that reported by China in early days of confirmations. These top 10 countries have a total GDP of about $50 trillion which is around 57% of the global GDP value.

As stated earlier – this is serious.

At this current moment, the most important tasks in the hands of the governments of every countries are to contain the growth and spread of the virus, and also find a cure for the disease caused by the virus to control the mortality rate. It is now widely recognised that a collective and committed effort by every citizen and government is required to tackle this issue.

“COVID-19 is causing health emergencies and economic disruptions that no single stakeholder can address”

Klaus Schwab, Founder and Executive Chairman, World Economic Forum

The Impact

Although the governments of the world have announced their measures to tackle the menace of the virus, with the expectation of gaining controlling of the spread, they are acutely aware of the fact that the strict measures of social distancing and self-isolation are going to result in an economic slowdown for themselves and for the world. With the closure of most of the international borders for the time being, the aviation, tourism and travel industries have already experienced the economic shock caused by the spread of the virus.

In addition to this, the economic impact caused by social distancing measures and by the fact that people cannot join the workforce unless they are fully cured is also adding to the economic shock. With self-isolation measures strictly in place and enforced at an almost draconian level, consumer spending has experienced a shock which may likely extend into the future, and may well take a long time to return to the norm – or whatever the new normal will look like.

“The coronavirus pandemic has driven the global economy into a downturn that will require massive funding to help developing nations. We have entered a recession that will be worse than in 2009 following the global financial crisis. It is now clear that we have entered a recession. We project a rebound in 2021, but only if we contain the virus and prevent liquidity problems from becoming a solvency issue”

Kristalina Georgieva, IMF chief

These statements clearly indicate the risk of losses to the business due to lack of new business and loss of recovering the investment from existing businesses. While medical professionals across the world are developing containment policies and guidelines to control the growth of the virus, the central banks and economists across every nation are looking for and finding ways to limit the negative shock of the impact of this virus on the growth of their economy.

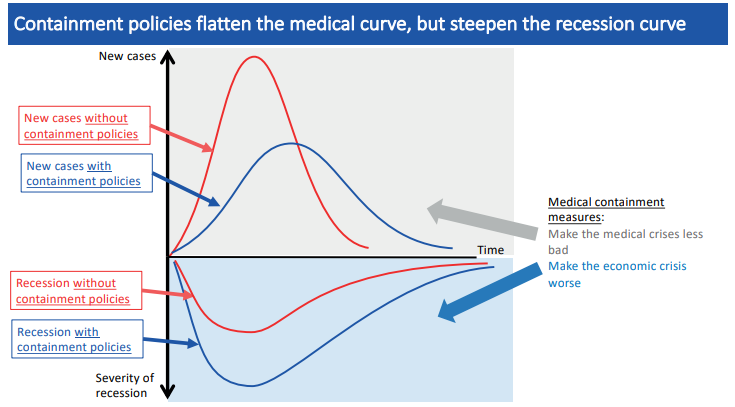

Figure 3 presents a set of curves demonstrating the impact of medical containment measures on new cases of COVID 19 vs. that on the economic recession. This information is sourced from the book “Mitigating the COVID19 Economic Crisis”, and an excerpt reads “In the top panel (the medical outcome), the red curve suggests what the curve would look like without containment policies; the blue curve suggests what it would look like with containment policies. The blue curve is a flatter version of the red curve due to containment policies. In short, containment policies flatten the curve. In the bottom panel (the economic outcome), the red curve illustrates the economic losses (negative growth) when there are no containment policies; the blue curve suggests the recession’s evolution when containment policies are imposed. The blue curve is steeper and deeper than the red curve in the bottom panel, i.e. just the reverse of the top panel.”

“Flattening the infection curve inevitably steepens the macroeconomic recession curve“

Pierre-Olivier Gourinchas, IMF Economic Review editor

This statement is true as we are all living in an interconnected economy. As previously mentioned, the immediate impact of this situation is visible on the aviation, travel and tourism sectors. Travel – whether locally or internationally – is almost at a standstill. According to aviation data provider, OAG, many countries are now operating less than 10% of flights, compared to the same period last year the previous year. The knock-on effect of lockdown is therefore catastrophic for hotels, hospitality and many other business sectors. Consumer spending on non-essential items has reduced; people are adopting a wait-and-see approach where everyone is putting their big-ticket purchase plans on hold for now. If this continues, small businesses will be the first ones to experience a severe impact which will have an inevitable ripple effect into medium and large businesses.

Investor sentiments across the globe are already negative with the major stock markets falling in recent times. It is evident that, with these socioeconomic disruptions, the world is moving towards a serious situation in the financial system which may increase the probability of global recession in coming times.

The Mitigation

At this stage, there is no real clarity on how long it will take to control the spread of the virus and how long will this pandemic last. According to media reports, a drop in new cases is often followed by another increase the next day. It would be prudent at this point to focus on lessons learned from historical crises. As observed in previous crises, if the economic situation of a geography results in job losses, non-earning consumers will face difficulty in paying their monthly dues towards their credit obligations such as mortgages and other consumer credits. Businesses may find it difficult to find buyers to sell their products and services to which will have an impact on their revenue stream, thus impacting their cash flow. In order to have enough of a cash buffer, business may start drawing down their credit lines which may result in a liquidity crunch in the financial market in the short term, if not in the longer term. However, support from governments and a timely introduction of favourable policies may help banks and the economy in general.

Role of Central Banks or Regulators

Credit lending by banks over the business cycle has been historically procyclical in nature. This means that banks lend more during the good times and reduce lending rapidly in the bad times, especially to small and medium enterprises (SMEs) and high-risk borrowers. The regulations such as IFRS9, which demands a higher provision amount based on lifetime default rate for customers in stage 2, further restricts banks to lend less during challenging times. What is critically important here is to anticipate the negative impact of economic disruptions caused by the COVID-19 virus and develop ways to mitigate the negative impact. Some of the ways the central banks can control the negative impact are:

- Lower the countercyclical buffers

- Reduce capital requirements allowing banks to operate temporarily below the BASEL Capital requirement levels

- Allow the banks to operate below the 100% Liquidity Coverage Ratio

- Allow forbearance for SMEs

- Hold the capital increases under Basle III reforms requirements for some time

These measures may help in mitigating a reduction of credit supply in the market, although losses and reduced equity buffers for banks and financial institutions will still be a cause of concern for the financial markets.

Role of Banks and Financial Institutions

While governments and central banks around the world are busy – and will continue to be busy – bringing in policies and reforms to control the negative impact of the COVID 19 pandemic on the economic environment of the world, banks and financial institutions must start putting together planning and analysis to gauge the impact of this pandemic on their respective portfolio. It is important that new lending may slow down in recent times, banks must start focussing on revisiting their capital requirement calculations. The spread of COVID-19 and the medical containment efforts may have a significant impact on the earning capacity of the end user, which, in turn, will reflect in their credit payment behaviour. This may lead to accounts moving from lower Probability of Default (PD) bucket to higher PD bucket which, in turn, may lead to high proportion of Non-Performing Loans in the bank’s portfolio. Clearly, the knock-on effects of the pandemic are creating a long chain of consequences for banks.

In order to assess the accurate PD of their borrowers, banks must make sure that the Behaviour Scorecards used to measure the risk of default of individual borrowers are up to date and are measuring the risk accurately. Applying appropriate re-calibrations of the Behaviour Scorecard to align the predictions to the recent portfolio default rate will help. In addition, in order to estimate accurate capital requirements, scenario analysis must be conducted for each portfolio of the bank.

Another most important line of action is to manage the collections functions effectively. While the business-as-usual function, with some enhancements, may work for people who are not affected by the negative impact of the COVID19 spread, it may not work for those impacted by the same. A best practice would be to make use of dedicated Collections Models to prioritise the collections queues. If a dedicated collections model is not available, the Balance at Risk approach should be adopted using the Behaviour Scorecard available at the bank. For customers who are impacted by the shock, it is highly recommended to negotiate an agreement with them and restructure the loan by offering benefits such as an extended repayment period, or a moratorium of 3 to 6 months on monthly instalment payments. On one hand this initiative will give the customer the necessary respite at difficult time, while at the same time the gesture will also help the bank gain positive points from a reputational risk perspective.

As we know, from a business growth point of view, COVID 19 is inevitably going to impact the way the workforce of the world will work. Considering this major shift, it is important for banks to come up with strategies focussing on digitisation and perhaps moving towards digital acquisition and lending. In addition to offering traditional products on their digital platform, banks can also design a portfolio of new products which would cater to the changing needs of the customer as the economy starts recovering from this shock.

During the Global Financial Crisis (GFC) of 2008, the calibration of bank credit ratings was increasingly challenged by the persistence and depth of the economic crisis. It is extremely important for banks and financial institutions to recalibrate their application scorecards to match the through-the-door incoming population. As was noticed during the GFC, the profile of the incoming population during the recession period was different to that which the scorecards were developed on. As a result, accurate risk assessment of those applications could not be performed. Therefore, it is an absolute must for every bank to review their scorecards through validation and recalibrate them to align the predictions from those scorecards to the real inflow of the population. Although, it may take a while to get a recent sample where COVID-19 impact can be assessed from a recalibration perspective, it would be advisable to increase the monitoring/validation frequency of the scorecard to assess its performance.

Another important aspect of account management that will help in risk mitigation in difficult times is credit limit management of revolving credit lines. While a Credit Line Decrease is not always welcomed, at times like this it is far better option to review the portfolio to identify accounts which are significantly impacted by the crisis and manage their limit as the bank may deem fit. The utilisation of revolving products increases substantially during a crisis and it is important to review the utilisation levels to ascertain appropriate credit limits for such products. It will help the bank reduce the level of risk in the form of reduced ENR, and reduced capital requirements as the total commitment will get reduced.

For secured products, such as mortgages, although the risk of payment default is high, the risk of the value of the collateral going down in near to long term future cannot be ruled out. Therefore, it is important to re-evaluate the assets under the mortgage portfolio more frequently to assess the impact of the change in the collateral value. While more frequent physical evaluation may be not possible and may also be cost-prohibitive, banks can consider alternate evaluations using tools such as House Price Index (HPI), which can help banks and financial institutions gain a fair understanding of the value of the collaterals in their portfolio.

In addition to all these portfolio management activities, flawless operations of the bank’s activities and adherence to internal and regulatory policies is of utmost importance at this critical time. Models and strategies developed using Machine Learning Techniques can greatly assist the banks in formulating the necessary policies and procedures. However, implementing well-planned models and strategies in their day-to-day operations is the crux to gain the maximum benefit.

Because without action, nothing happens.