COVID-19 SOLUTIONS

Managing Credit Risk

Combatting the impact of the crisis is now a top priority for every bank

What can banks do to help themselves – and their customers?

As strict policies are rapidly being enforced around the globe to help manage the upward curve of positive cases, Qarar fully understands the concerns banks are having to face while navigating the current situation. At the same time, banks are playing a very significant role during the COVID-19 crisis as general shock absorbers for their customers, and for the economy at large. Banks and the financial services sector are under the spotlight.

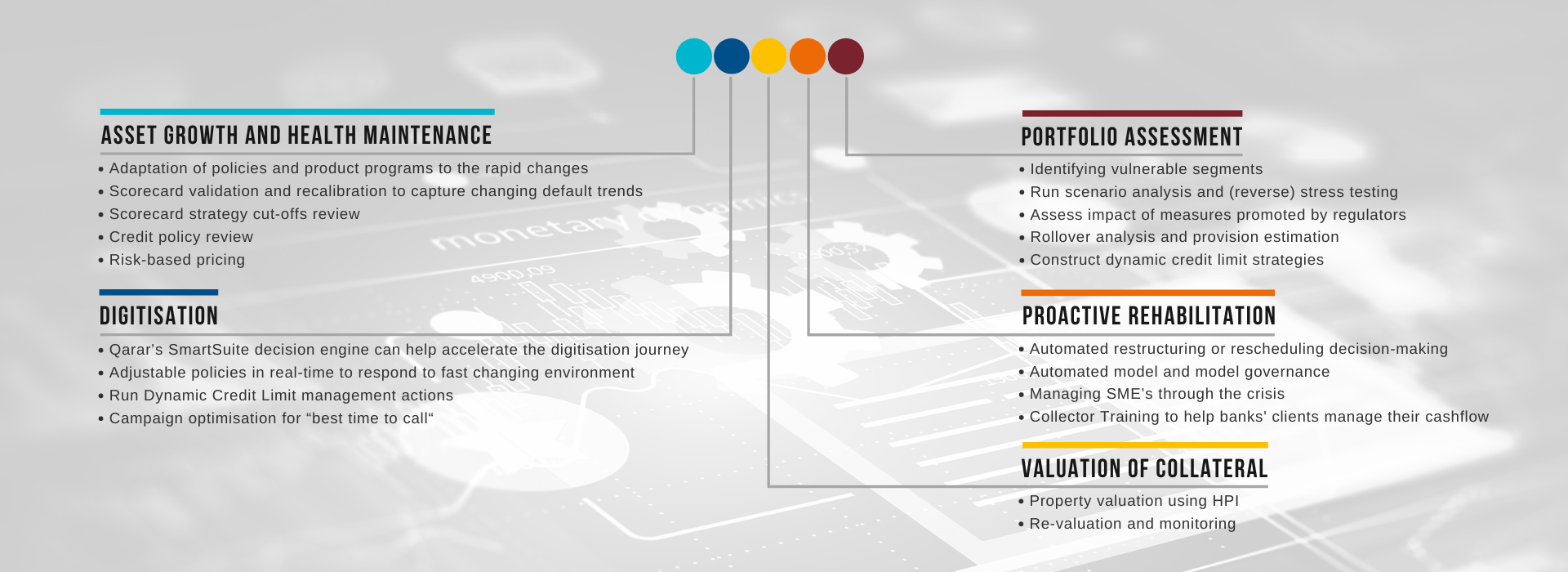

To put it bluntly, the proactive response taken by banks – right now – will determine the real impact of their future survival, and maybe come through this even stronger. Qarar can help you flatten the curve across all weakening and critical KPIs by employing our vast experience in analytics, automated decision-making, and portfolio management. Based on our knowledge and unique perspective, we have addressed the major implications for the banking sector and detailed the best-practice solutions through our core areas of expertise.

These uncertain times are also impacting consumers in many ways such as livelihood, income, spending patterns and repayment behaviour. As a result, the one thing that is CERTAIN is a direct impact on the way the portfolios are managed. Qarar recommends lenders follow a 3-stage approach:

Stage 1 – Assess

An advisory activity where all touchpoints in use across the Credit Life Cycle must be identified, analysed and assessed against identified impacts, such as payment deferment, economic conditions and the lockdown impact over the last few months

Stage 2 – Calibrate

The current situation is unprecedented with no previous data to rely on. Therefore, expert judgment must prevail during these times to recalibrate actions/decisions based on impacts identified from stage 1

Stage 3 – Adapt

Credit life cycle actions must be adapted to the current situation and expected behaviours. These range from originations, account management and collections. Regulatory compliance actions must be similarly adapted, ranging from provision through to ECL calculations